A global strategy with

a personal focus

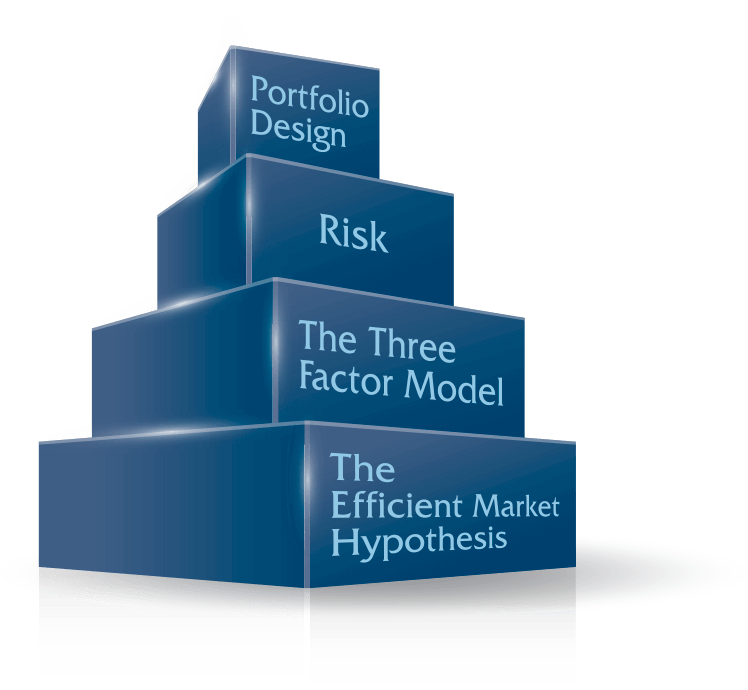

Our Investment Strategy integrates the following four elements:

The Efficient Market Hypothesis

Free and open markets incorporate all information quickly and security prices follow a random walk model.

The final key

The final key is to apply each of the above to security markets around the world with a scientific balance of how much capital goes to each market. The first four chapters of the book, Great Minds. Great Wealth. Great for Your 401k., each discusses their appropriate layer of the pyramid in depth.