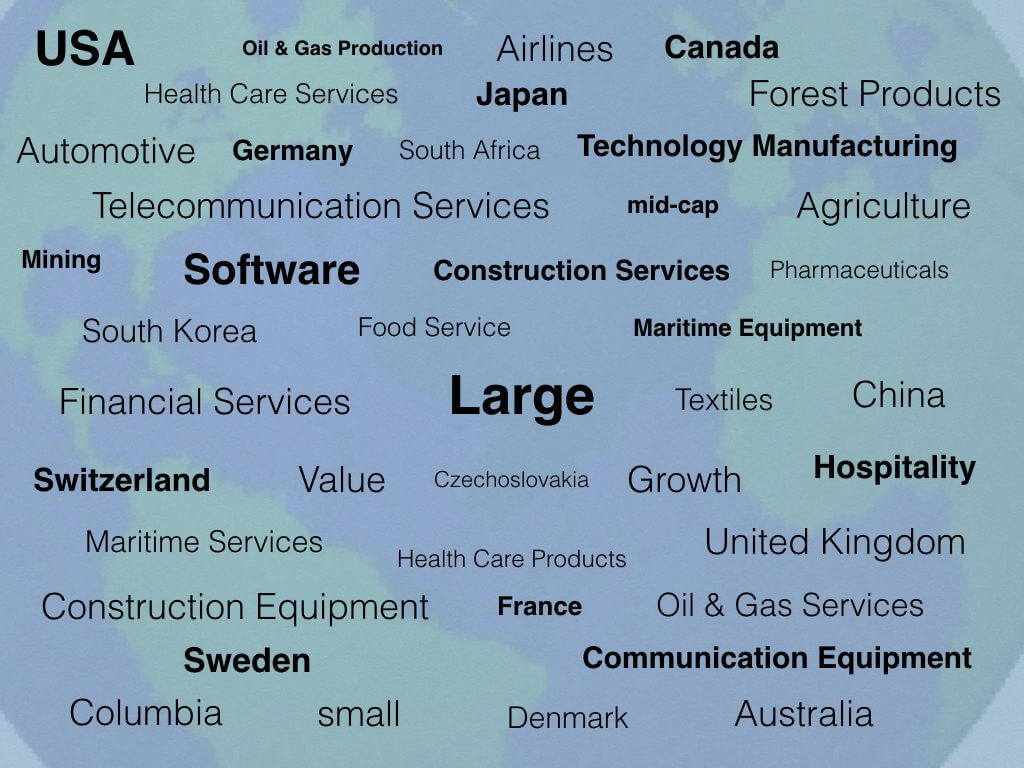

By having a hyper-diversified portfolio you’re almost guaranteed to have a position in the next boom stock such as Google from 1997 to present or Microsoft from 1986 through 2000. What do I mean by hyper-diversified? 1000 stocks? 3000 stocks? Think of 12,000 stocks.

That’s right. The portfolios I manage have a position in something on the order of 12,000 stocks. That’s huge. But is it too big? Although it may sound like a lot, it’s minuscule when compared to the countless millions of companies that comprise the global economy. However, by holding on the order of 12,000 stocks one has a thorough exposure to the top companies that move the global economic engine forward.

Why does one need such a broad exposure? Take, for example, the steel industry. By holding a broadly diversified portfolio, one gets positions in carbon steel, stainless steel and specialty steels such as bronze and copper. Further, the investor gets exposure not only to large steel companies, but also to small steel companies. And finally, the investor gets exposure to nearly every steel market in the world, ranging from established countries like the U.S.A. and Australia to emerging economies such as Czechoslovakia and Thailand.

This, in turn, brings into play things like some countries and steel mills benefitting when energy prices fall while in other countries the steel industry does better with high energy prices. The profitability equation, and thus a company’s stock price, depends in part on who comprise its customers and what forms the biggest piece of its costs. In some locations, the biggest cost may be the energy bill while in other locations it may be the labor bill.

The beneficial part of the equation for the investor is that all the bases are covered and each base, or company, is fighting to be as profitable as possible for the circumstances at hand. Thus, the hyper-diversification benefits the investor in both the offensive and defensive modes.

Another fascinating thing to keep in mind is that through the investment methods and products I use I’m able to accomplish a scientific, balanced hyper-diversification position for a cost that is approximately 70 percent less than what one would face through a traditional mutual fund or private equity product. Thus, scientific hyper-diversification helps to maximize the investor’s return per unit of risk and unit of cost. That’s good.

As always, let me know if you have any questions or if I can be of additional assistance.

Thanks,

Rod