Do you know how much to expect your portfolio to move daily? This is something every investor should know, although it’s rare that one does. Fortunately, however, it’s rather easy.

For simplicity, assume your portfolio value is $100,000 and assume it’s all equities (stocks) with same total volatility as the Dow Jones Industrial Average (DJIA), the benchmark most often cited. This isn’t a perfect assumption, but it’s good for a quick approximation.

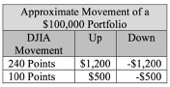

Without explaining all the statistics, you can expect your $100,000 equity portfolio to move MORE than $1,200 on one out of three days and LESS than $1,200 on two out of three days.

How does this translate into a figure on the DJIA? In short, we can expect the DJIA to move more than 1.2% on one out of three days and less than 1.2% on two out of three days. But DJIA movements are reported in “points”, not percent. Nevertheless, the conversion is easy.

With the DJIA currently at approximately 20,000, a 1.2% movement equals 240 points. Wow! That’s a lot of points! So, in short, we can expect the DJIA to move up or down MORE than 240 points on one out of three days.

So how much can you expect a $100,000 portfolio to move if the DJIA goes up 100 points? This is simple, as it’s:

(100/240) x 1.2% x $100,000 = $500.

Hence, in quick, “back of the envelope” terms, if the DJIA goes up 100 points you can expect your $100,000 equity portfolio to “gain” $500 (see table).

To be sure, volatility ebbs and flows. Hence, we tend to have intermittent periods of both low and high volatility. But over time, one can expect a $100,000 highly diversified equity portfolio to move up or down $1,200 on one out of three days.

When can we expect the market to go up versus down? We don’t know, as security prices follow a “random walk” model, meaning their daily price movements are random. Nevertheless, because we can expect capitalism to move forward (also see last week’s post), over the long haul we can expect upward price movements to outpace downward price movements.

What about different equity classes such as domestic vs. international, large vs small, etc.? Yes, this does make a significant impact and I plan to write on it in the future. Also, bonds dampen volatility, which is another subject for a future post. But to rapidly convert today’s DJIA movement to your equity position, without taking time to log on, the information above will get you “eyeball range” for a quick approximation. I hope this helps.

Thanks, Rod